Equity Crowdfunding: A Model for Financing Start-Ups and Small Businesses

An introduction to equity crowdfunding: the trends, regulations and opportunities that surround an emerging financing model

8 minute read

Crowdfunding, the practice of funding a project or venture by raising small amounts of money from a large number of investors, has expanded over the past decade as a potential new funding source for start-ups and small businesses. Crowdfunding gives retail investors the ability to support and invest in different projects, businesses, and causes that align with their personal values. In response, recent amendments to legislation in the United States and Canada has attempted to open up the market for Equity Crowdfunding in the hopes of leveraging its potential for job creation, technological innovation, business competition, and its accessibility to retail investors.

The Global Crowdfunding Market

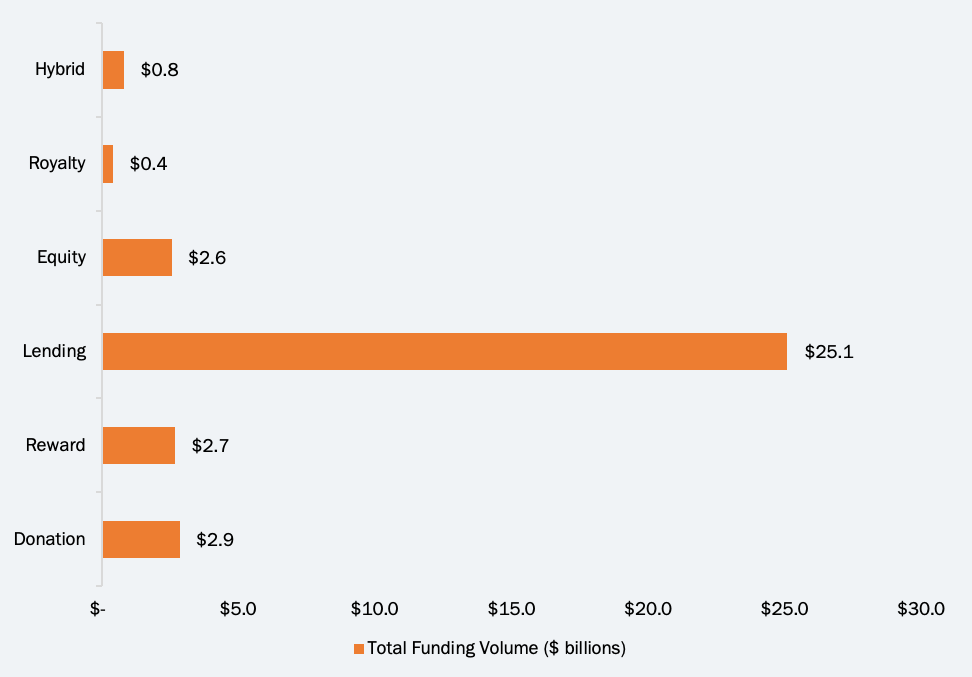

Crowdfunding is divided into several different of models. Four in particular have amassed the largest pools of capital over the years: Reward-Based, Debt-Based, Donation-Based, and Equity-Based Crowdfunding. They are all unique financial instruments that offer different benefits and costs.

Reward Crowdfunding: Reward Crowdfunding offers individuals a chance to contribute to a project or product in which they are interested, in exchange for current or future goods or services (often referred to as ‘perks’). In the most successful cases, it allows companies to essentially pre-sell their product, while both securing the capital they need and testing market demand. These models vary between two scenarios: either ‘keep-it-all’ (KIA) or ‘all-or-nothing’ (AON) contracts. In the former, the entrepreneur or company keeps all of the funding that they raise on the platform; in the latter, they set a goal amount and only collect funds if the target is met within the time constraints set at the beginning of the crowdfunding campaign.

Global Crowdfunding Volume, By Model (2015)

Debt Crowdfunding: Debt-based

crowdfunding, also known as lending-based crowdfunding or peer-to-peer (P2P) lending, arose in the UK and the US in 2006. It became a vehicle for borrowers to obtain a loan at a lower interest rate than through traditional avenues (i.e., banks) and allows lenders to potentially receive a higher rate of return than through traditional investments (i.e. savings or government bonds). It continues to have the largest funding by volume compared to other models of crowdfunding and is growing rapidly.

Charity or ‘Donation’ Crowdfunding

Charity-based crowdfunding (also referred to as ‘donation’ crowdfunding) takes place when an individual, company or organization accepts charitable donations.

Equity Crowdfunding

Equity Crowdfunding involves investors contributing money in exchange for a tangible stake in the venture they are funding; most often in the form of stock.

The Importance of Equity Crowdfunding

Equity Crowdfunding has emerged as a particularly useful tool for small businesses and start-ups that may struggle to raise initial seed funding, as many entrepreneurs are funded by a mix of credit cards, personal savings, and a local network of friends and family. In response to growing interest and demand, governments in both the US and Canada have recently amended legislation to allow new ways for equity crowdfunding to play a part in small business and start-up financing.

Millennials & Crowdfunding

A particular success point for Equity Crowdfunding is the Millennial generation’s embrace of it as an accessible impact investing tool. Crowdfunding taps into a generational desire for a transparent, interactive, peer-to-peer style of investing that facilitates direct access between ventures and individual investors, accredited or otherwise, who are interested in seeing the direct impact of their funds.

Key Statistics

Millennials are 70% more likely to donate to a crowdfunding campaign than Generation Xs and 200% more likely than Baby Boomers.

In the US, 69% of Millennials considered investments a way to express their social, political, and environmental values while only 36% of Baby Boomers felt the same way

Big Picture: Canadian Equity Crowdfunding Landscape

$70M

Value of the Canadian equity crowdfunding market (2015)

15

Equity-specific crowdfunding portals operating in Canada (June 2016)

27

Companies listed on the platform of exempt market dealer FrontFundr (July 2016)

Where does Equity Crowdfunding Meet the Mark, and Where Does it Fall Short?

Benefits of Equity Crowdfunding

Challenges

Encourages innovation & job growth by decreasing barriers

Facilitates market competition

Fills a financial gap through democratization of capital

Adapts financing patterns to changing demographics

Determines market interest

Poses risks to retail investors

Can create heightened information asymmetry

Has a long-term uptake

The multiplier effect remains uncertain

Capital management challenges still persist

Despite its many laudable benefits, the growth of Equity Crowdfunding as an industry practice faces serious headwinds. Some of the most pressing concerns cited by researchers and experts include: existing legislation amendments do not sufficiently overcoming uncertainty to attract new users; the platforms pose inherent risks to inexperienced and non-accredited investors; there remains a lack of high return from companies leveraging these platforms; and administration costs remain potentially prohibitive limiting the capacity of crowdfunding platforms to be economically feasible.

What It Means

Our full findings explain all the aforementioned challenges, opportunities and achievements to-date in more detail, along with a detailed summary of the North American regulatory landscape for Equity Crowdfunding. The research ultimately outlines that, if sufficient steps are taken to mitigate risk, crowdfunding could eventually become a well-established, mainstream method of raising capital for emerging ventures.

Both the full report and slide deck are available at the top of this page.